A number of franchise candidates exhibit a high degree of trust as they travel through the franchise process. In some cases it begins with the initial contact between a candidate and the franchisor representative and builds gradually over time. In other cases, the level of trust may arise at a certain point in the franchise evaluation process: for example, at a meeting with a franchisor representative or during a Discovery Day visit.

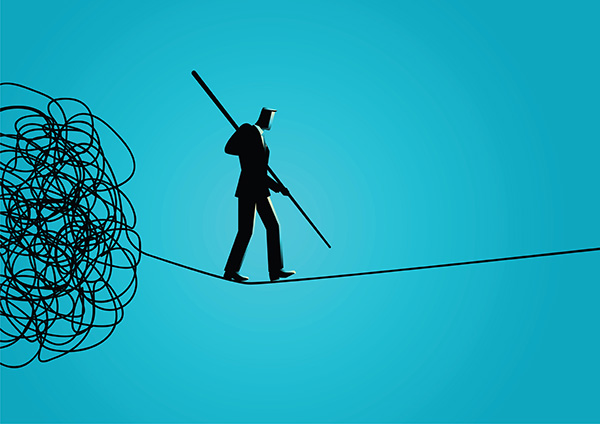

I believe that a successful franchisee-franchisor relationship should rest upon a foundation of mutual trust. However, when it comes to selecting and evaluating franchise opportunities, a candidate has to cast trust aside and proceed with the same mindset as if they were buying an independent business. Sometimes, the concept of a franchise model can cloud the way a franchise prospect evaluates a franchise opportunity. This is because some individuals believe that investing in a franchise significantly lowers the risk of failure, which isn’t always true.

Harkening back to the days when the U.S. and Russia were negotiating a nuclear arms treaty the words most often used were “Trust and Verify.” This mantra should be applied to the franchise selection and evaluation process.

There are several reasons why the Trust and Verify approach is applicable to evaluating a franchise:

- Franchise sales people are responsible and compensated for growing a franchise network. Some may be overzealous in their sales tactics. Be cautious about claims of support and success if you are to become a franchisee.

- If you ask important questions, especially related to the franchise agreement, be sure that the answers are confirmed in writing.

- When it comes to financial information including revenue, cost and expense data, be sure that the information you receive is confirmed. Don’t be reluctant to confirm with some existing franchisees.

- The same evaluation and due diligence utilized when considering the purchase of an independent business ought to be applied to a franchise. If the franchisor doesn’t make a financial disclosure under item 19, be wary of the reasons why. Unless the franchise is a new start up, there aren’t many valid reasons for not disclosing revenues. A number of franchise consultants believe that the lack of an Item 19 disclosure, except for a start-up franchisor, should be a reason to avoid that franchise.

- Despite the occasional negative comments, existing and former franchises are the best source of information regarding the performance and viability of a franchise program.

- Utilize professional advisors, including an accountant and franchise attorney, to assist you during your evaluation process.

- Obtain information that will enable you to compare various franchise programs.

- When all is said and done remember the adage: “If something sounds too good to be true, chances are it is.”

There needs to be a certain level of trust in all business relationships, however, when it comes to evaluating franchise opportunities the mantra should be trust and verify in order to avoid making the wrong decision.

Not sure how much can you afford?

Fill out our Franchise Affordability Calculator

Voyage Franchising

Related Articles

Franchising and Murphy’s Law

When it comes to franchising, Murphy’s Law comes into play more often than desired. In many cases, a new franchise takes off slower than anticipated.

Growing Your Franchise System Takes More Than Leads

The emphasis on franchise system growth is as old as franchising, having been accepted as the indicator of a quality franchise.

Franchisors Need to Avoid Wasting Their Franchisee Leads

When franchisors strategize their system growth, the major focus is placed on the amount and quality of their franchisee leads.

The Two Traits You Need in A New Hire

After owning 4 successful businesses, in different business sectors, there are two common attributes my good hires have shared; Curiosity and Tenacity.

Monitoring your Consumer Sentiment Is Key to Selling your Franchise

In the franchise industry, franchisors can view comparisons and relationships between consumer satisfaction for the products or services a franchise offers.

The TOP 4 Traits Of A Successful Franchise System

These traits lead to low franchisee turnover, an attractive investment opportunity, outlet growth and brand recognition and consumer satisfaction.

The #1 Reason You Are Scared to Open Your Own Business

Owning a business is hard. Each venture has its differences – different customers, different go-to-market strategies, different business partners.