Franchising provides a great opportunity for you to own a business.

It can enable a route to success, growing from one franchise to hundreds of franchises. But, like any business, there are risks. Franchising is unique in that certain franchise systems help reduce this risk, while others can increase this risk based on false securities offered under the franchising umbrella.

Franchising does not make a bad business model a good investment.

There are multiple types of franchises – such as restaurants, retail and a variety of service- based opportunities. There are also a variety of maturity levels.

However, despite the vast opportunities, investing in a franchise is the same as any business investment. It involves risk. The most effective way to maximize the opportunity for success and minimize the risk of failure is through more data research and analytics. This is the kind of information that can lead you to better decision making.

To obtain a deeper view into this aspect of franchising, we analyzed a database of 2,154 franchise systems and their Item 20 data from 2012 to 2016 FDDs.

In our most recent Facts & Figures report: Diamonds in the Rough: Emerging Franchise Systems Have Potential for Growth, there are 974 systems with less than 25 outlets. This represents 45% of all franchises in our database.

With almost 1,000 franchise opportunities with less than 25 outlets, there are several investment opportunities in which you may never have heard. Investing into an emerging franchise could be a better option than investing into an established franchise brand. Here are three reasons why an emerging franchise investment might be right for you:

- Better Communication with CEO

If you’re more entrepreneurial, an emerging franchise allows you more freedom to engage with senior executives. The number of employees at an emerging franchise is smaller than a larger established franchise. Typically, the CEO or President is a founder and continues to be engaged in the day to day operations of the franchise. This gives you the opportunity to speak freely with them and you can share ideas or concerns as they arise. - More Growth Opportunities

Start-up and emerging franchise opportunities are seeking entrepreneurial investors who will help them expand. The ability to negotiate a larger territory and a development agreement gives you the chance to grow your franchised business in a way that suits your needs. - Similar Risk to Larger Franchises

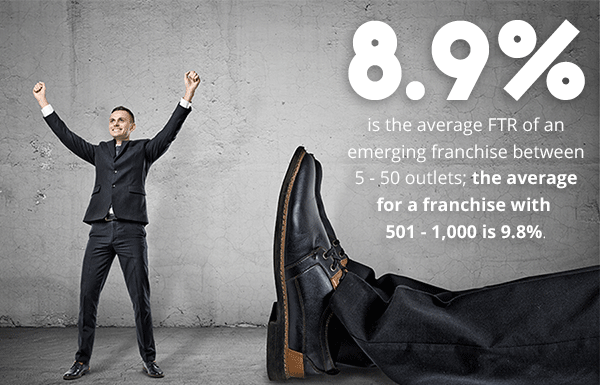

Franchisee Turnover Rate (FTR) is the number of outlets that close or are transferred every year as a percentage of all franchisee outlets. According to our research, the average FTR of an emerging franchise between 5 and 50 outlets is 8.9%. The average FTR for a franchise between 51 to 1,000 outlets is 9.8%. This means that there is an inherent risk within franchising, but an emerging franchise may not have any more risk than a franchise with 500 or 1,000 outlets.

None of these factors replaces the need to research a specific franchise system in depth.

Investing into a franchise is about making money. This is priority number one for any investor. If a franchise opportunity does not meet your financial return expectations, be a consumer, not an investor.

Not sure how much can you afford?

Fill out our Franchise Affordability Calculator

Voyage Franchising

Related Articles

Open Your Own Independent Business or Buy a Franchise?

From the outset, you’ll have some obvious questions you’ll need to ask yourself before you can start formulating your own strategy to begin your venture.

New York Times Investigates Subway’s Abuse of Franchisees

New York Times investigation into the use of questionable practices by one its Franchise Development Agents that culminated in the agent acquiring two of a franchisees Subway stores.

The Fall of A Giant – Are Subway’s Healthiest Days Behind Them?

Not even a decade ago, Subway was the champion of healthy eating. In fact, they were the largest fast food chain in the world.

What Sub-Franchising Really Means

Sub-franchising is frequently confused with other franchise models, including area developers, master franchisors, regional developers.

Maximize Market Penetration and Branding with Multi-Unit Franchisees

Multi-unit franchising grows in popularity, in the Quick Serve Restaurant sector, this model continues to expand into other franchise sectors in popularity.

The Top 10 Franchise Grade Facts & Figures From 2017

Detailed studies on emerging franchise success rates, errors in Item 20 disclosure and sector performance, Franchise Grade’s reports help you.

A Road Block to Franchise Growth is Right Under Your Nose

New franchise growth is the top priority for emerging franchise brands. Many of these franchises have an obstacle on the road to more franchise locations.